Women & Worth: Join the Conversation to Better Women's Financial Lives

I recently returned from London and heard many times while navigating the city “Mind the Gap!” The phrase is the warning to beware of the gap between the train and the platform while riding the tube. This got me thinking about another less infamous yet more important gap that exists throughout the world. The pay gap. Though most of us know what this is, we likely don’t conceptualize that the pay gap is just one of the many gaps that lead to a financial lifetime of inequity for women.

As we prepare to mark Equal Pay Day in the U.S., which symbolizes how far into the next year a woman must work to have earned what a man had the previous year, I invite you to join the conversation about Women and Worth. We will tackle issues that affect women’s financial lives. Starting with the series of gaps, let’s continue the conversation about what we can do as individuals, leaders and credit unions to better women’s financial lives.

A FINANCIAL LIFETIME OF GAPS

Women’s financial lives are marked by a series of gaps – the pay gap to start is coupled with the opportunity and advancement gap, which leads to the lifetime earnings, retirement, and wealth gaps. It should be noted that for women of color, the gaps and their impacts are significantly worse. Because of these series of gaps, women are continually playing catch up in their financial lives, and in all honesty, most never bridge the divide, whether it’s pay, advancement, earnings, or retirement.

Pay Gap

The pay gap is measured through two lenses: “All Work,” which examines earnings of all working women, and “Equal Work,” which compares earnings based on job function. The good news is that the pay gap has been lessening over the years for both the “All Work” and “Equal Work” groups, though at a very slow pace.

However, the bad news is two-fold. First, “Equal Work” – doing the same job with the same qualifications still does NOT mean EQUAL pay. Additionally, there are far fewer women who make it into the “Equal Work” group throughout their career and if they ever do, it takes them considerably longer to get there. In 2023, the Payscale Gender Pay Gap Report found that the “All Work” group of women in the U.S. earns $.83 for every $1.00 men make. When we look at “Equal Work” according to job function, women earn $.99 to men’s $1.00.

Opportunity & Advancement Gaps

As women progress in their careers, they climb the career ladder at significantly slower rates and their ladders are considerably shorter than their male counterparts. 60% of women over the age of 45 occupy individual contributor roles compared to 45% of men in the same age group. Furthermore, the Payscale Report found just 4% of women make it into an executive role at any given time in their career compared to 8% of men.

Even at the top of the ladder women make less than men. For women executives, the pay gap is $.72 on the dollar to what men make, and in the “Equal Work” group, that number is $.95 to the men’s dollar.

Lifetime Earning Gap

Now let’s look at how the pay and advancement gaps impact women’s lifetime earnings. Comparing “All Work” women ($.83 to $1.00 gap) over the span of a 40-year career with the gap staying constant and assuming a 3% cost of living increase annually, women will earn $4.3M. Using this same calculation, the lifetime earnings for all men is $5.2M. For the ”Equal Work” group, ($.99 on the $1.00) lifetime earnings increase to $5.14M for women. That’s $900K less earnings for the “All Work” group in a lifetime and $70K less for the “Equal Work” group. What makes the gap so impactful to women’s financial lives is that women live longer on average and those lost earnings could have been reaping the benefits of a lifetime of saving and investing.

Bottom line: Less pay, less opportunity to advance into positions that pay more combined with less pay for those who make it to advanced positions, is a formula for a lifetime of diminished earnings.

Retirement and Wealth Gap

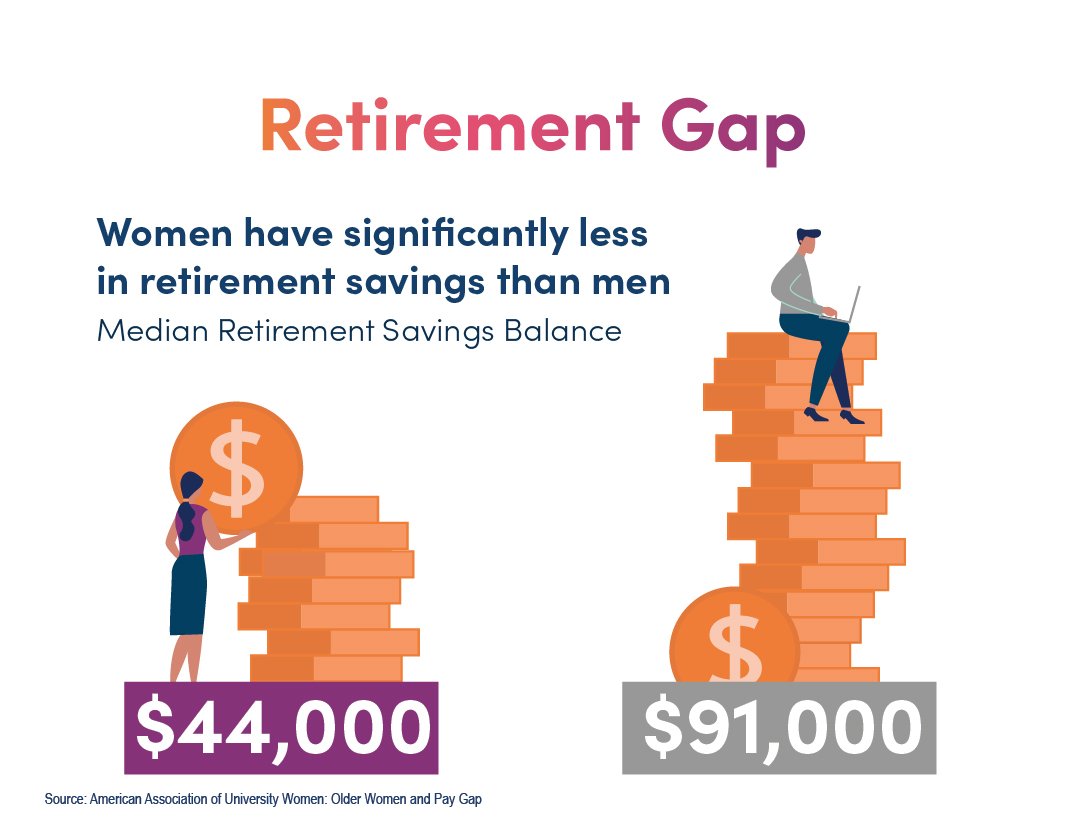

When we reach retirement, the pay gap has turned into a significant wealth gap. According to the American Association of University Women the average woman has $.32 in wealth for every dollar of the average man. That number is pennies on the dollar for women of color. In 2023, the TransAmerica Center for Retirement Survey found that men have a median retirement savings balance of $91,000 whereas women have a median balance of just $44,000.

Because women have made less over their lifetime, their Social Security benefits are lessened as well. This means the significantly lower savings balances and diminished social security benefits must last longer diminishing the quality of women’s lives when they need resources to care for themselves the most.

LET’S CONTINUE THE CONVERSATION

It’s time to mind the gap(s) by normalizing the conversation about money. Yes, looking at the gaps can be devastating and certainly feel overwhelming, but knowledge is power. The only way we overcome the gaps and make Equal Pay Day a thing of the past is to acknowledge the issue(s) and work together toward solutions as individuals, leaders, and credit unions.

We believe continuing the conversation is important. So please tell us, which gaps sparked your curiosity for deeper exploration? Do you want to know why women don’t make as much as men at the top and what we can do about it? Are you doing great things at your credit union to advance women and their financial lives? Are you curious how to help women save and invest more? Let’s rise to the challenge to continue the conversation and work toward bettering women’s financial lives today and for future generations.

About Women & Worth: Our goal with Women & Worth is to have discussions that lead to developing strategies and solutions to help better women’s financial lives. We believe as an industry that helps strengthen people’s financial lives, credit unions are uniquely positioned to lead this initiative and bring about impactful change.

Join the conversation on social media or email us.